Bitcoin fell 3% in less than an hour in a “healthy” price correction. In this article, we will explore the current pricing of BTC and the main crypto news, including Ethereum (ETH) updates.

After a strong recovery the previous day, the main cryptocurrency showed volatility on Wednesday, maintaining its trademark. With three consecutive days of swings above 3%, the consistent recovery movement of Bitcoin is positive. A larger correction would be healthy, considering that the cryptocurrency has accumulated an impressive 86% increase in the year.

BTC Mining

Bitcoin mining activity is on the rise again, with the hash rate and mining difficulty set to reach new records. After facing reduced profit margins during the bear market, miners are recovering alongside the increase in the BTC/USD price, which rose 70% in just the first quarter of 2023.

The Bitcoin mining difficulty has reached new all-time highs in recent months, which is an indicator of competition for block subsidies. Next week, the difficulty is expected to increase by about 2.1%, reaching 48.91 trillion – 13 trillion more than at the beginning of the year. This shows that the mining market is recovering significantly and that miners are investing in more resources to maximize their profits.

Bitcoin Analysis

After reaching resistance at $30,900, as predicted in previous analyses, BTC/USD began a consolidation movement with high volatility in the same price range seen in May/June last year. The price corrected to support at $28,300, but now seems to be stabilizing at that level. A consolidation period similar to last year’s is expected before the market resumes a directional upward movement. Tracking price action evolution is essential to evaluate future movements and define Bitcoin investment strategies.

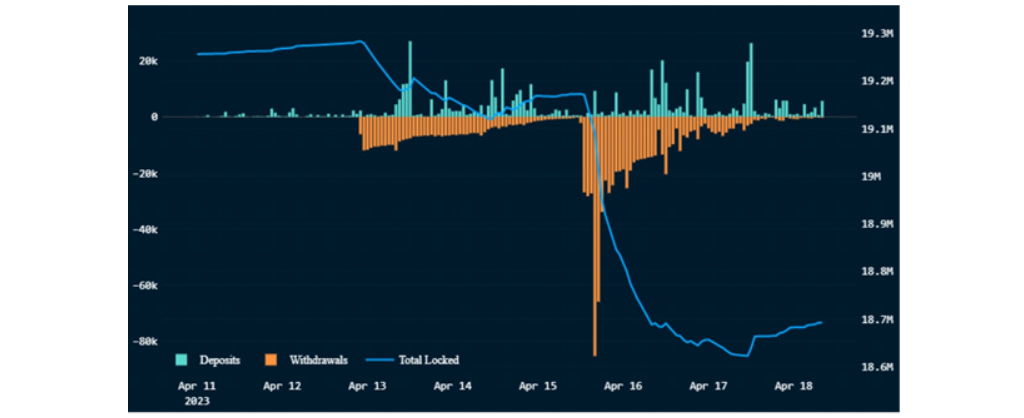

Ethereum: ETH Deposits

For the first time since the Shapella hard fork on April 12, ETH deposits in the Ethereum Beacon Chain have exceeded withdrawals. Although more than 1 million ETH has been withdrawn since then, many addresses have made new deposits, resulting in a positive balance. According to Nansen, an on-chain analysis company, deposits have outpaced withdrawals, with a volume of 124,000 ETH deposited on April 17, almost twice the total volume of withdrawals of 64,800 ETH.

The Shapella hard fork was a critical update for Ethereum, unlocking millions of ETH and representing a risk of massive selling pressure. However, most validators are redepositing their stakes in staking. With the Ethereum Beacon Chain approaching 4 million ETH in staking, the update seems to have been successful in keeping validators engaged and incentivized to maintain network security.

Ethereum Analysis

After the Shapella update, ETH/USD recorded a gain of 13.55% in just four days, indicating that the update was successful. However, Bitcoin continues to dominate the market and pull Ethereum down, causing the cryptocurrency to give back almost all of its gain from the last week. Despite this, the trend continues to be upward, with Ethereum being supported by a green trend line.

Conclusion

In summary, the cryptocurrency market has presented several significant movements in recent days. Bitcoin, despite its volatility, has shown consistency in its recovery, indicating a positive scenario for investors. Ethereum, with the Shapella update, has presented significant appreciation and a resumption of ETH deposits in the Beacon Chain. In addition, Bitcoin mining has recorded a significant increase, showing that the mining market is recovering.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply