In this article, we will explore the expansionary cycle, a phase of economic prosperity driven by monetary policies and market movements. From the fundamentals of the cycle to its consequences, including the impact on stock markets and consumption, we will uncover the complexities of this stage of the economic cycle. By connecting the dots that lead from the bottom to the top and, inevitably, to the intervention of Central Banks in the face of inflation, we will provide valuable insights for investors to navigate wisely in this dynamic scenario. This is the first chapter in a series that aims to equip you with the knowledge necessary to understand and anticipate market movements, highlighting the importance of preparing for the contractionary cycle that we will cover in our next articles. Be ready to deepen your understanding and improve your investment strategies.

Interpreting economic events and Central Bank monetary policy decisions is a fundamental skill for a trader. Predicting the next market movement using indicators such as GDP, unemployment rate, inflation and payroll requires good sensitivity to the macroeconomic scenario. In this article, we will explain in detail economic cycles, their characteristics and how to identify which moment we are in.

Economic Cycle

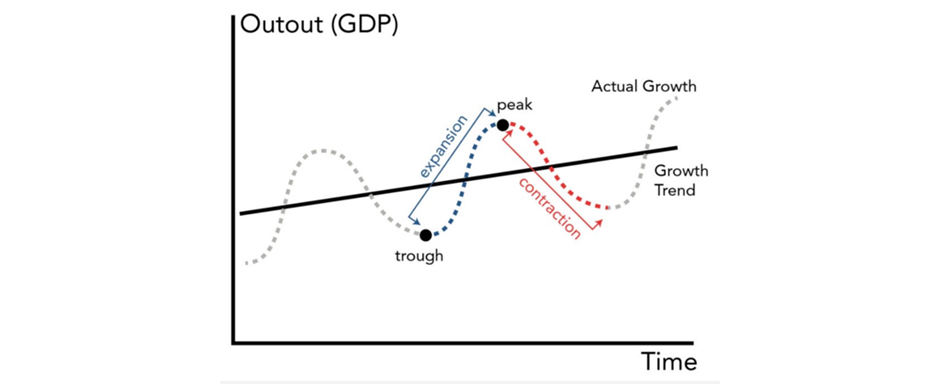

You may have noticed that, over the years, the economy fluctuates from good to bad, giving the impression that we go through lean and fat periods, regardless of the effort we make to avoid bad times. This is the economic cycle graph. Note that, although the economy is always rising, it oscillates between highs and lows, with high moments being called an expansionary cycle and low moments, contractionary.

Economic cycles are very strong and difficult to control. Of course, we would always like to be in an expansionary cycle, with an abundance of money, expanding companies, lots of jobs and growing demand. However, there is no free lunch, and everything has a price. Let’s understand the stages of each cycle and why we need to go through more difficult times, starting with the expansionary cycle.

The Fund

Starting at the bottom of the economic cycle, we have just emerged from a recession. Companies that survived after cutting their expenses as much as possible, cutting employees and adapting their offer to lower market demand, that is, lowering prices to become more competitive, now find a more fertile scenario. Central Banks around the world have a common objective: to achieve their country’s inflation target. In this context, we admit that inflation is within the target, after all, companies cut prices to compete for low demand.

With inflation within the target, Central Banks have some tools to stimulate the economy again and force economic growth. The main ones are the “compulsory deposit” and the “base interest rate”.

The compulsory deposit is a percentage of how much the Central Bank obliges banks and financial institutions to deposit part of the funds raised from customers, via demand, time or savings deposits, into a Central Bank account. In this way, they are able to regulate part of the money that is injected into the economy. If the reserve requirement is high, banks have less money available to release as credit, and vice versa.

At this initial point in the expansionary cycle, where the Central Bank wants to stimulate the economy, the compulsory deposit requirement will be lower, freeing banks to grant more loans and, consequently, purchasing power.

The base interest rate is the amount that the government will pay you for the money you lend through public bonds. This value is very important, as it is considered the lowest investment risk available. In other words, it is the comparative basis for all other investments, as the minimum return required for other assets will be what you would receive for public bonds, plus an extra amount for the risk of not investing in public bonds. This extra increase will depend on the size of the extra risk that the asset represents, but the important thing here is to understand that the base interest rate will guide all investments, as the required return will always be the zero risk rate determined by the Central Bank, plus the individual risk rate of each asset. Every 45 days, the Central Bank brings together its committee members to discuss adjusting the rate, with the option of raising it, lowering it or leaving it unchanged. In Brazil, this meeting is called COPOM, and in the USA it is called FOMC.

To start the expansionary cycle, Central Banks, which have now reached their inflation target, also reduce the base interest rate to the minimum possible. This science of how much to raise or lower the rate is very difficult to control, as it is a cannon shot at the economy. Any slightest wrong change can throw plans off track, and is one of the main factors that economists try to predict.

With low rates, we have two ends affected. The first is the loan giver, who will receive less income for their money lent to the government or companies through public or private bonds. As the yield is now very low, the loan giver is forced to risk a little more in order to earn significant income again. In this scenario, shares of companies and ventures become interesting again, as they can offer a much higher return than the rate that is now low.

The second side affected is the borrower, whether individuals or companies. Now that the interest rate is low, it is cheaper to take out loans, whether to spend on consumption or to start a business. It’s the ideal time to take that startup project out of the drawer or expand an existing one, and in doing so, consequently, generates the creation of new job vacancies.

Let’s connect the dots

The government reduced the compulsory deposit, freeing up more money for banks to lend. The interest rate also decreased, thus making it more accessible to borrow this money. Those who have resources to lend no longer see an advantage in this loan due to the low rate, directing their capital to companies. Companies receive this influx of investment and use it to expand, generating jobs as a result. The consumer finds a greater supply of jobs and begins to earn more money. If you need extra capital for consumption, you have easier and more attractive access, given that interest rates are low now.

Now that consumers have more money, they consume more, increasing the demand for products and services, which forces companies to expand to meet the new demand, thus completing a cycle of strong prosperity.

At this point, we are right in the middle of the expansionary cycle. With all this consumption and production, we see an increase in countries’ GDP, stock markets reaching new highs and an optimism that seems to have no end. This phase of the cycle makes a large part of the population forget that we live in cycles. The shortest ones last 2 to 4 years, and the longest ones last 7 to 11 years. Regardless of the measures taken, a cycle is a cycle, and at some point we need to return to reality.

The top

After a long period of abundance, companies have already tripled, quadrupled or increased many times their size compared to the beginning of the cycle. Many unicorns have emerged, which are startups that, in their first years of life, are already worth unimaginable figures, creating many new millionaires and generating more and more money.

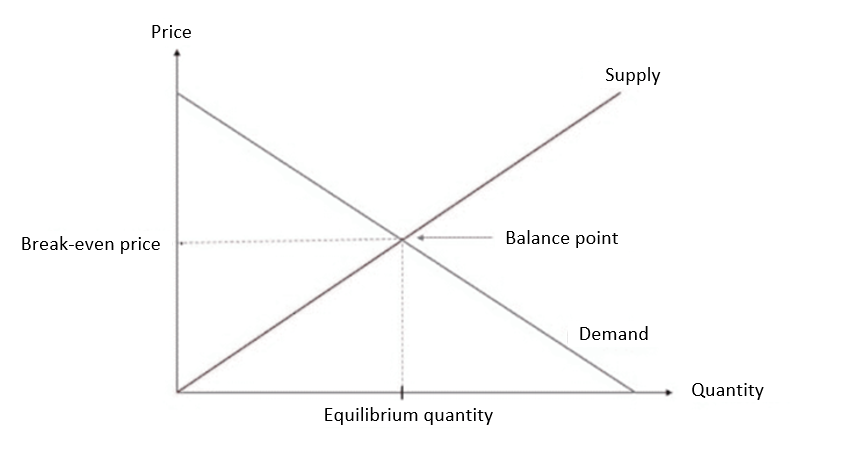

All this money has generated absurd consumption, and companies no longer need to produce more products to meet demand. This graph represents the supply x demand curve. This is the basic principle of the economy, and all companies seek the balance point, where they can offer their products at the highest prices, meeting all demand without missing any opportunities.

With consumption on the rise and limited production, as it becomes increasingly difficult to hire qualified labor – after all, everyone is hiring and expanding – companies begin to raise the prices of their products to find the balance point. This happens at all layers of production. Inputs and commodities are being increasingly consumed, forcing producers to raise prices. Skilled workers become increasingly scarce, forcing employers to offer higher wages, which in turn increases purchasing power and consumption, requiring more production.

Can you understand the vicious cycle? This increase in everything ends up assuming uncontrollable proportions, distorting future projections and causing people to lose track of the true value of money today, resulting in the continuous readjustment of prices upwards. As we all know, this is called “inflation”.

Inflation

This is where the villain lives. Prices keep rising, whether for products or services. Every month we have a reading of the country’s inflation; in Brazil, it is called IPCA, in the USA, CPI. This metric weights an average of a basket of general consumer products, bringing the country’s inflation to a single number (Central Bank’s target to achieve). With inflation well above the target, the time has come for the Central Bank to intervene, marking the top and putting an end to the expansionary cycle.

Conclusion

This article was part 1 of the economic cycle, the expansionary cycle. We saw that the economy moves in cycles and how the expansion cycle behaves, often guided by the tools of Central Banks. In an upcoming blog, we will talk about the contractionary cycle.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply