We start 2024 by exploring recent fluctuations and projections for the new year. We will see everything from the performance of global stock markets to the movement of assets such as gold and the EURO/USD, discovering valuable insights for attentive investors. By examining trends in markets and global influences, we seek to provide a comprehensive view that guides strategies in the face of the uncertainties and opportunities that present themselves.

Stock markets perform lower in the first trading session of the year.

And so the year 2024 begins, promising to be a very prosperous period, and expectations are high. We will have important events boosting the financial scenario, such as the American elections and ongoing geopolitical conflicts.

Now, let’s analyze the end of 2023.

European stock markets ended the year on a high, marking their best performance since 2021. This positive result was driven by expectations of changes in the tightening trajectory of global Central Banks, fueling a vigorous recovery in the last quarter. Meanwhile, American stock markets experienced a more significant correction in the last trading session of 2023, after a prolonged sequence of gains that began in mid-December. This occurred after the Federal Reserve signaled the end of the monetary tightening cycle and left the possibility of starting interest cuts at the end of the first quarter of 2024, in accordance with market expectations.

The Brazilian stock market followed this correction and ended the last trading session of the year without major variations, closing at its historic high. It was an encouraging close after a prolonged period of decline. Meanwhile, gold registered a fall in the last session of 2023, pressured by the increase in interest rates on Treasuries, which compete with the precious metal as a protection option.

The year 2023 has certainly presented significant challenges for investors and portfolio managers. It began with the threat of global inflation, rising interest rates and concerns about a possible hard landing of the American economy, in addition to a significant slowdown in China. Along the way, a banking crisis in the US generated panic in the markets, but was promptly contained by the Fed. A turnaround occurred in Switzerland, with the collapse of a bank and the rapid incorporation of Credit Suisse by competitor UBS to avoid broader impacts on the global financial system. When everything seemed lost, the Federal Reserve gave positive signs of improvement in economic conditions, indicating control of American inflation. At the end of 2023, the long-awaited sign of the end of the monetary tightening cycle in the USA finally came, paving the way for a loosening of rates in 2024.

Now, let’s evaluate the beginning of this year.

China marked the beginning of the year with two contrasting data on industrial activity. Despite this, with no signs of a deeper crisis, the Chinese economy did not prevent the Ibovespa rally in 2023, which is expected to continue this year, albeit with less intensity.

The Ibovespa started the year in decline, following the closing of the US stock exchanges on Friday (when the B3 did not open). Despite this, it was supported by the shares of the oil and mining sectors, driven by the good performance of commodities. However, it has already accumulated a drop of 1.35%. NY indices remain negative after estimates that global economic growth in 2024 will be lower than expected, mainly due to the weakening of the Chinese real estate market and high interest rates in the US and Europe. These estimates were reinforced by the US manufacturing PMI, which recorded a drop from 49.4 to 47.9 in the final December reading, below expectations of 48.2. Investments in construction in the country were also slightly below forecast, rising 0.4% in November compared to October, while the forecast was +0.45%.

Looking back at this week…

The first two weeks of the month historically have the lowest liquidity due to the year-end recess. This week’s main indicators include activity in the US labor market, such as ADP and, mainly, the December Payroll, which will release on Friday.

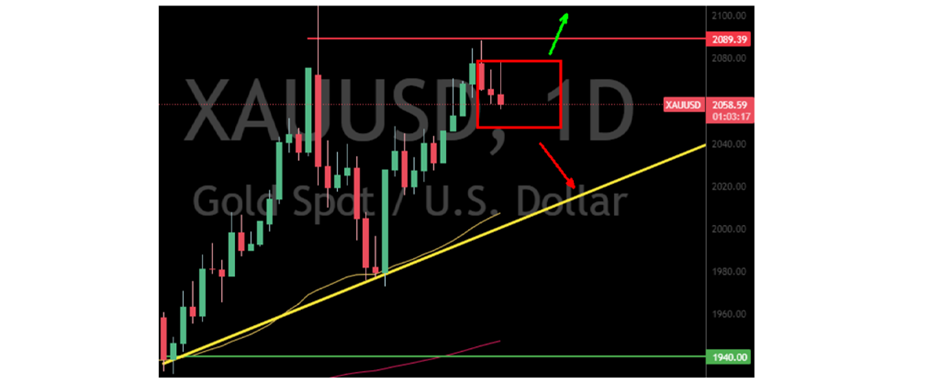

Gold Analysis

The XAUUSD gold contract experienced three consecutive days of declines after reaching significant resistance at $2,080.00. Despite an early correction, market participants will await the week’s indicators to determine a directional move. In this context, the most appropriate strategy would be to wait for the payroll report on Friday, placing buy and sell orders with a substantial margin of price difference before the data is released. This approach allows you to take advantage of the movement regardless of which direction the market takes.

Euro/USD Analysis

The EURO/USD pair reached the two targets from the last panorama and began a strong correction, driven by the appreciation of the US dollar during the period. To measure this correction, we use the Fibonacci retracement, which reached 0.5 Fibonacci today. Due to the significant fluctuation in the first trading session of the year, it is challenging to predict the direction in the coming days. We recommend especially monitoring the 0.5 Fibonacci level; If this support is lost, it may be strategic to enter a sell position, while if resistance remains, there is a tendency for consolidation until the payroll report.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply