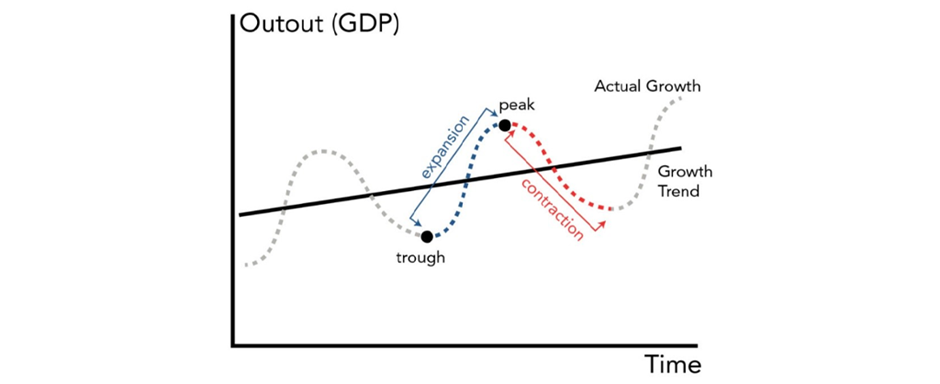

The economy operates in cycles, constantly alternating between different phases, with an average of 4 to 10 years each. Understanding which phase we are in is crucial, as is knowing how to react to the measures and events that characterize each of them.

In this article, we will discuss part 2 of economic cycles, focusing specifically on the Contractionary Cycle. If you haven’t read part 1, where we explore the Expansionist Cycle, click here.

Unraveling the Contractionary Cycle – The top

At this stage, we enter the top of the economic cycle, marking the end of the expansionary cycle and the beginning of the contractionary cycle. When examining the graphical representation of the economic cycle, we realize that, despite the continuous growth trend, there are moments of decline, and it is precisely these periods that we will focus on now.

We are at the peak. This is a time of full employment, low interest rates, and widely available credit, but also of inflation. It is not an exclusive concern of Central Banks, which seek to force inflation back to the target. It affects us all, reflected in rapid increases in rent, fuel, food – practically everything rises at an impressive speed.

While we can handle the higher bills for now and maintain our standard of living with the salary increase, how long will that be possible? Changing cars becomes unfeasible, and cell phone updates only occur every two years. High costs force us to rethink even that trip planned for the end of the year.

Could this be a result of the current government management? Will there be measures to contain inflation? Explore with us the developments of this scenario and the strategies to face the challenges at the top of the contractionary cycle.

Recession

The invoice arrived. Regardless of the government’s attempts to expand, display a more robust GDP than the previous year and present solid numbers at the end of the mandate, the Central Bank, as an independent entity, must adopt measures to achieve its inflation target, currently 3 to 4 times above ideal.

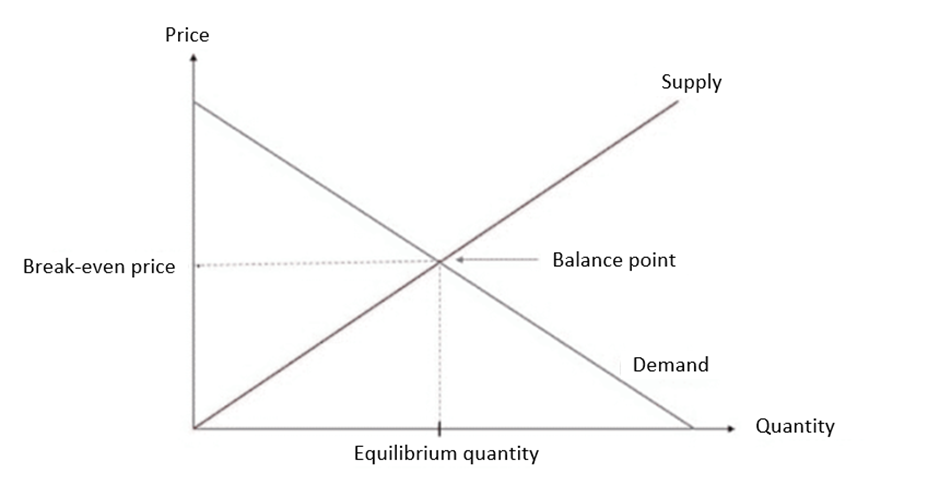

The plan is clear: remove money from the economy, reduce people’s purchasing power and reduce consumption. This puts pressure on companies to reduce prices to compete for reduced demand, acting as a brake on inflation.

The tools used are the same as those used in the expansionary cycle, but with an opposite approach. Increasing banks’ compulsory deposit requirements reduces the margin available to offer loans, restricting credit for both individuals and companies. This makes it difficult for entrepreneurs to execute projects and prevents consumers from financing their expenses.

The second tool, the base interest rate, plays a crucial role. By increasing interest rates, the Central Bank discourages consumers from taking out loans, making financing for goods such as cars and houses much more difficult. This is made worse by high inflation, which has already made these goods considerably more expensive.

Loan givers, now investors in stocks and risky assets during the expansionary cycle, are again attracted by high interest rates. The movement is proportional: as interest rates rise, more investors sell their positions in risky assets and migrate to fixed income assets, such as government bonds. This movement creates a herd effect of selling on the stock exchanges, which perform significantly below periods of expansion.

With less investment and demand decreasing due to less money available, companies not only reduce prices to compete in reduced demand, but they also find themselves forced to reduce production capacity. This results in branch closures, employee layoffs and, in some cases, declarations of bankruptcy.

To reduce production capacity and cut expenses, companies close branches, lay off employees, and, in some cases, declare bankruptcy.

From this point on, the bottom can last for some time, before starting a new expansionary cycle. This is the current scenario, and understanding these nuances is crucial for investors to navigate this challenging phase of the economy. Explore with us strategies to face challenges and anticipate opportunities amid this prolonged contractionary cycle.

Conclusion

This concludes the second part of our exploration of the economic cycle, focusing on the contractionary cycle. Right now, we are experiencing this cycle all over the world. In the United States, although some believe they have reached the peak, members of the American Central Bank still mention the possibility of one more increase before an eventual fall.

There is a theory known as the “butterfly effect” which postulates that the flapping of a butterfly’s wings in Japan can trigger a hurricane in Brazil. The truth is that everything is interconnected and understanding the possible changes arising from each economic event, monetary policy decision and even catastrophe is of paramount importance for those operating in global markets, such as the Forex market.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply