According to the latest economic news: the American interest rate rises by 0.25%, and Jerome Powell’s remarks after the FOMC meeting generate speculation. We will also discuss the banking crisis, the drop in EUR/USD, and gold behavior.

Interest rate cycle may have come to an end

The interest rate cycle may have come to an end as the American interest rate increased by 0.25% last Wednesday, reaching 5%-5.25%. Although this change was widely expected, speculation now focuses on the post-FOMC speech.

Post FOMC

After the FOMC meeting, the president of the United States Central Bank, Jerome Powell, spoke about the future of the country’s monetary policy. Powell suggested that the tightening cycle may be coming to an end, but it is still being evaluated. He also acknowledged that the banking crisis had an impact on the decision not to increase interest rates as much as expected.

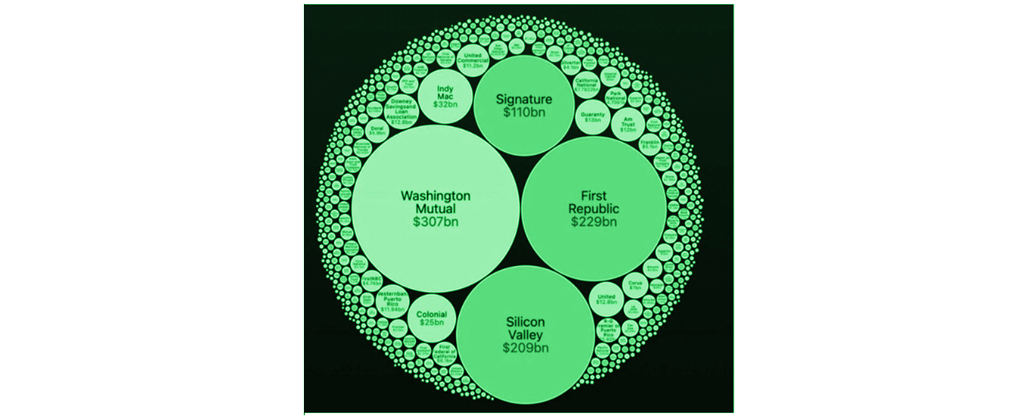

Although Jerome Powell, president of the United States Central Bank, stated that the banking sector is “solid and resilient,” it is important to observe the impact of recent news on the banking sector. The First Republic Bank, the second-largest American bank, had a 99% drop in its shares in the last six months, highlighting the challenges faced by the sector.

American banks that went bankrupt due to asset prices. Source: FDIC Acquisitions by other banks may be used as a smokescreen to mask the banking crisis. Today, another regional bank, First Horizon, plummeted 36%, indicating that the banking crisis may be far from over.

The drop in First Horizon’s shares and the 1.9% decline in the main American index, the S&P500, this week show that the NY stock market is not excited. The expectation of high interest rates for longer and the credit crisis to come, driven by the banking sector’s poor performance, tends to devalue risky assets as access to money becomes increasingly difficult.

Bets continue to go against

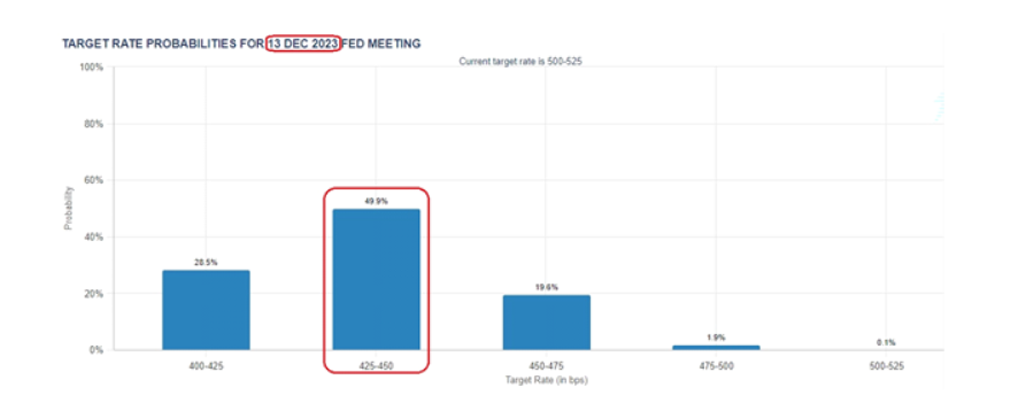

Despite the president of the United States Central Bank, Jerome Powell, making it clear that there will be no relief in interest rates this year, futures market bets continue to go against it. According to the CME Group, the majority of bets indicate that the rate will remain unchanged at the next meeting and a negative adjustment in the following ones, ending the year at 4.5%.

There is no doubt that the bets are not aligned with Powell’s speech and may be pricing something utopian, which, if not realized, we may see a correction in risky assets.

Gold analysis

Gold has been following an upward trendline and recently had an explosive jump, leaving a large wick above the resistance at $2,050. This suggests that the market is looking for protection, and gold may be a viable alternative in times of uncertainty.

Although today was a false breakout, it was a rehearsal for new highs that we will probably see in the future, especially with the devaluation of the dollar. Investors looking to diversify their portfolios may consider including gold as a form of protection.

Analysis of the Euro

There was also a meeting of the ECB where the interest rate in the Eurozone was increased by 0.25%, reaching 3.75%. The market was divided between a 0.25% and 0.50% adjustment, and with the change, EURUSD fell 0.5%, demonstrating disappointment in relation to expectations of higher increases compared to the increase of the Fed.

Even with the drop, the pair continues to respect the uptrend line and the 21-period moving average as support, creating a bullish flag along with resistance at $1.107.

Although the chart pattern signals an uptrend, both currencies are highly exposed to the upcoming inflation results, which will be the determining driver.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply