Bitcoin has been trading above US$30,000 since early morning on April 11, registering gains of more than 45% in the last 30 days and reaching the highest level in ten months.

This movement has left sellers in a difficult situation. More than 87% of all trades in the futures market were on the selling side, resulting in a total settlement loss of US$145 million.

Despite the encouraging scenario, many traders are waiting for the release of the US CPI, which will take place on Wednesday, April 12.

Binance struggles to find banking partners in the US

Binance.US, the American arm of the Binance exchange, is facing challenges in finding a new banking partner to serve as the entry and exit point for its customers’ fiat funds in the US.

After the bankruptcy of the cryptocurrency’s three partner banks – SVB, Silvergate, and Signature – Binance is without banking services and depends on intermediaries to hold funds on its behalf.

In short, American customers will find it difficult both to acquire cryptocurrencies using their dollars and to redeem their crypto funds for a local bank.

Ethereum’s hard fork takes place on Wednesday

Ethereum has been appreciating this month with the long-awaited Shanghai hard fork, which takes place on Wednesday, April 12.

The update will allow participants who left their Ether locked in the new proof-of-stake network model to withdraw around 1.1 billion ETH in rewards, equivalent to over 2 billion dollars at the current exchange rate.

The big question is whether participants will liquidate their rewards or reinvest them. It is worth remembering that, after the update, the new Ethereum system will face strong competition from competitors such as BSC, Solana, Cardano, and Polkadot, which present competing characteristics to the ETH proposal and will compete for this massive redemption.

Bitcoin analysis

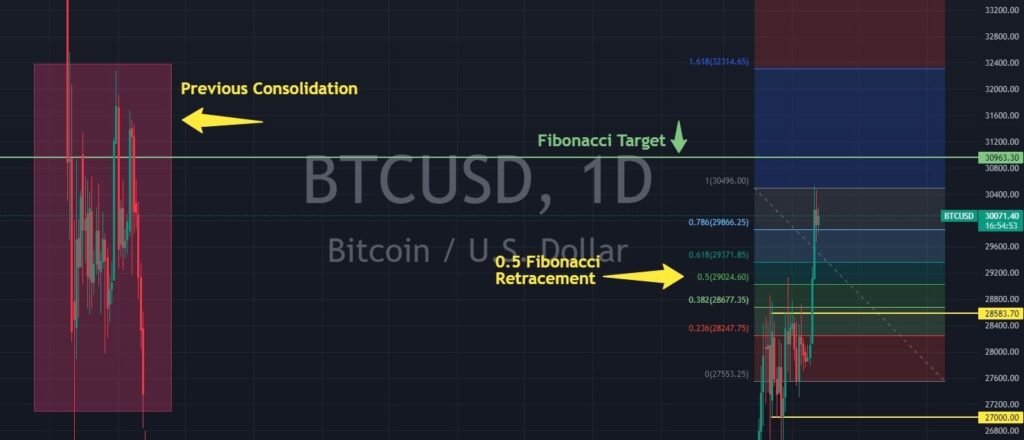

Bitcoin has broken through the previous consolidation zone and is now trading above US$30,000, an important price level because it is a round number, which creates a psychological factor in investors and becomes a resistance point. The next target remains close to US$31,000, traced in the previous panorama following a Fibonacci expansion. However, it is important to remember that:

01. We are right in the middle of a strong previous consolidation point between US$28,000 and US$32,000.

02. In the last two days, it has risen almost 8% without retreating, stopping just at the round number of US$30,000.

03. Tomorrow, there are US inflation data to be released, and many investors are waiting to position themselves.

Therefore, although the target is just above, there is a high probability of correction in the short term, finding around US$29,000 the 0.5 Fibonacci retracement. It is important to keep an eye on US inflation data, as they can influence the market and lead to an even deeper correction.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply