The dollar extended losses at the start of a new month to trade at its lowest since May 2018. Asian stocks drifted after a retreat in most U.S. equities with the exception of technology shares.

The euro led the charge against the beleaguered greenback and approached the closely watched $1.20 level. China’s yuan touched the highest since 2019 as manufacturing data indicated that exports are underpinning a recovery.

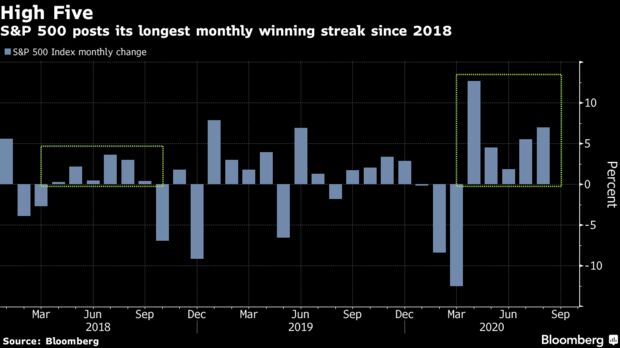

Australian shares underperformed, led by a decline in financials, while South Korean equities advanced as the government prepares to boost its budget in 2021. Equities fluctuated elsewhere in the region. S&P 500 futures were little changed after the benchmark notched a fifth consecutive monthly advance in August. European contracts rose. Treasuries were little changed.

With global stocks up 6% in August and 10-year Treasury yields almost 20 basis points higher, traders have been betting on the global economy’s recovery from virus shutdowns and continuing gains in tech shares. Still, with U.S. infections ticking up again and India becoming the world’s epicenter for new cases, the pandemic is far from beaten and investors will be scouring data this week for clues on the outlook.

“Following such a strong month and such a strong recovery since we saw the trough back in March, we do think we could see some turbulence over the next few months,” Tracie McMillion, head of global asset allocation strategy at Wells Fargo Investment Institute, said on Bloomberg Television. “We’re entering a seasonally weaker period, we’ve got elections on the horizon, and also we’re entering the fall and there could be some coronavirus escalation that also could start to worry market participants.”

The Dow Jones Industrial Average led U.S. losses earlier after its components were revamped, with Microsoft Corp. and Walmart Inc. slumping on concern China could block a possible sale of the video app TikTok. Apple Inc.’s surge as the stock split 4-for-1 lifted the Nasdaq 100 past 12,000 for the first time.

Elsewhere, oil rose in a tight range below $43 a barrel.

Here are some key events to watch this week:

- Reserve Bank of Australia hands down its policy decision Tuesday.

- ISM manufacturing data is due Tuesday in the U.S, Australia GDP is due Wednesday.

- U.S. jobless claims for the week ended Aug. 29 are due Thursday.

- U.S. jobs report Friday is forecast to show payrolls continued to rebound in August from virus lows.

Here are the main market moves:

Stocks

- S&P 500 futures were little changed as of 12:20 p.m. in Tokyo. The S&P 500 Index fell 0.2%.

- Topix index fell 0.2%.

- Australia’s S&P/ASX 200 Index dropped 2.3%.

- South Korea’s Kospi index rose 0.9%.

- Hong Kong’s Hang Seng Index rose 0.2%.

- Shanghai Composite Index was little changed.

- Euro Stoxx 50 futures rose 0.7%.

Currencies

- The yen rose 0.3% to 105.64 per dollar.

- The Bloomberg Dollar Spot Index dipped 0.4%.

- The offshore yuan was at 6.8186 per dollar, up 0.4%.

- The euro was at $1.1997, up 0.5%, near a two-year high.

Bonds

- The yield on 10-year Treasuries edged up to 0.71%.

- Australia’s 10-year bond yield rose one basis point to 0.99%.

Commodities

- West Texas Intermediate crude rose 0.8% to $42.93 a barrel.

- Gold rose 0.7% to $1,982.11 an ounce.

Source: Bloomberg

Leave a Reply