Despite there are more than 30 or more prominent candlestick patterns, the research team at ZERO Markets has selected the three most powerful and tested candlestick configurations, which can provide traders with more discretions and support for their own trading strategies. These configurations can suit different trading styles, including day traders, position (long term) traders, scalpers, and swing traders. These patterns are also applicable across a variety of financial assets, including Forex (foreign exchange trading), shares, commodities, indices and cryptocurrencies.

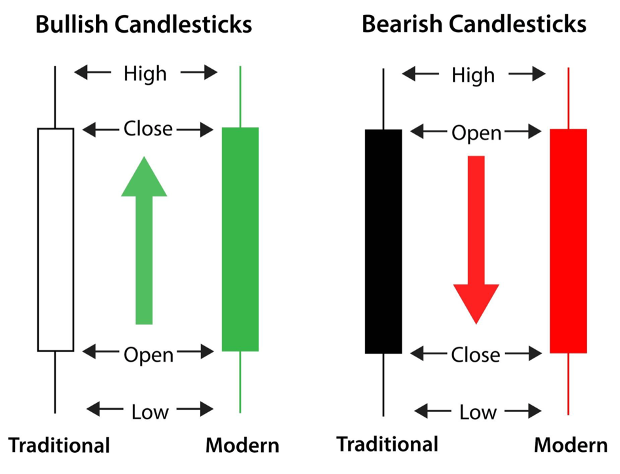

Basic Characteristics of Candlestick

The basic candlestick body is comprised of the open, close, high, and low points (Figure 1). The candle’s real body indicates the range between the open and close over a specific time period. A wider range indicates stronger momentum. The beginning of a candle’s life is defined by the opening price. Conversely, the completion of a candle is outlined by the closing price. The upper shadow of a candle indicates the highest price reached during that specific time period. On the other hand, the lower shadow indicates the lowest time reached during that time period.

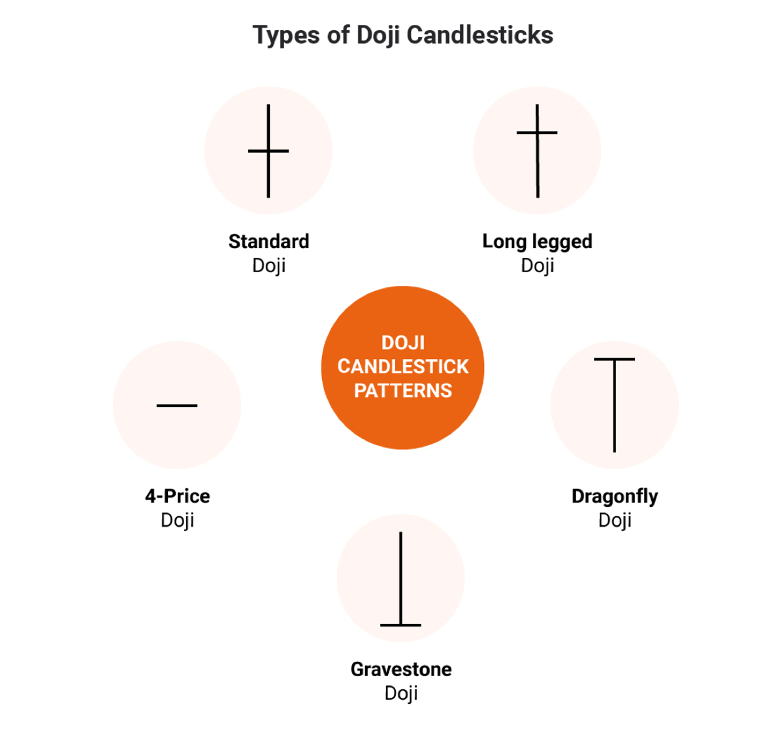

Doji Candlestick

The Doji candlestick pattern is seen when the opening and closing price of the candle is equal (Figure 2).

This Doji pattern ultimately indicates indecision between the market buying and selling forces. It could be interpreted as a potential point of reversal as the trend grows weaker, or a possible continuation of market trend, with the market, simply taking a breather. However, the odds of Doji can be enhanced when employing additional tools such as support and resistance. For instance, when a Doji is spotted at a resistance level, the Doji configuration becomes more meaningful, indicating sellers potentially taking control. In contrast, a Doji formation at the support level could indicate a bullish reversal.

One variation of the doji is the dragonfly doji, displayed with a long lower shadow with an open/close position near the high of the candle. This formation depicts sellers initially had the upper hand but ran out of steam, and buyers had taken over. Dragonfly doji patterns can be an effective bullish signal in oversold markets. In contrast, a bearish counterpart is known as the gravestone doji, which has a long upper shadow with the open/close positions near the lower end of the candle. A gravestone doji is potentially a sign of uptrend running out of steam. Nevertheless, it’s important to note that these doji patterns may not signal for an immediate trend reversal, but rather a susceptible change in trend directions.

Read more on:

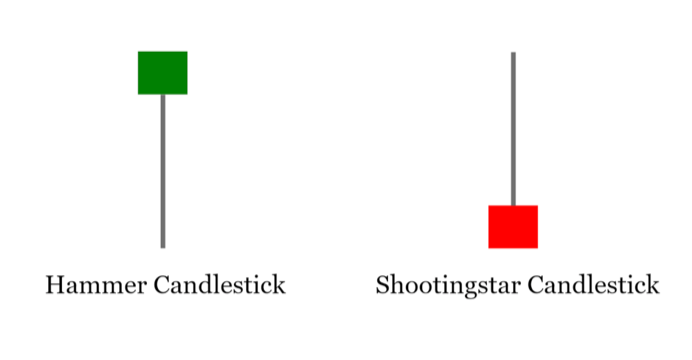

Hammer and Shooting Star Candle Patterns

Similar to the dragonfly and gravestone doji, the hammer and shooting star candlesticks configurations are popular for price reversal signals (Figure 3). However, they are also different as the hammer and shooting star patterns have a real body marked by the different open and close prices.

The hammer formation should have a real body located at the upper end of its formation, and often void of an upper shadow but has a long lower shadow that is at least twice the length of the real body. On the other hand, the shooting star pattern should have a long shadow on the upper end and a real body towards the lower end.

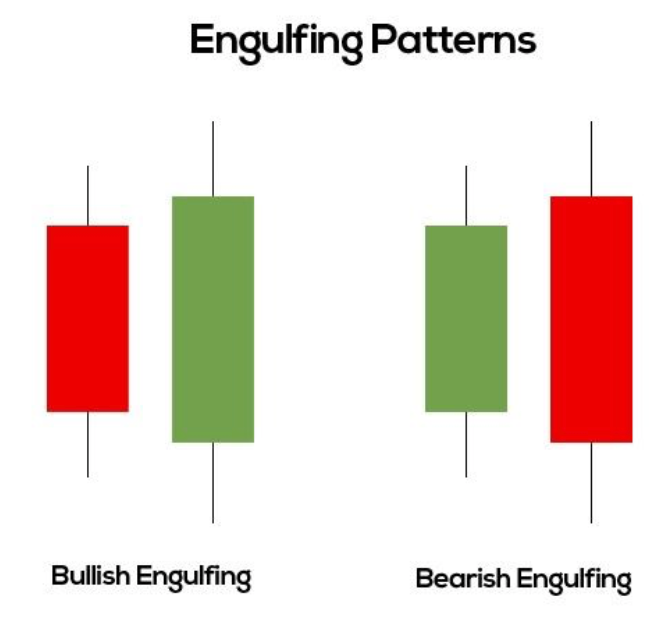

Engulfing Candlestick Patterns

Different from the doji and hammer patterns, engulfing patterns require two consecutive candlesticks to form the pattern, in which the second real body engulfs the first real body (Figure 4). Similar to the other candlestick patterns, it is most effective when used along with key levels or other technical indicators. A bearish engulfing pattern is composed of a small green (white) body followed by a larger red (black) real body that engulfs the previous candle’s body in a rising market. Conversely, a bullish engulfing is most effective in a downtrend with the first candle in red being engulfed by a larger green candle’s real body. It’s worth noting that in engulfing patterns, the shadows are irrelevant, only the prior real body must be engulfed by the next.

Zero Markets provide a variety of account types suitable for all types of traders including ECN Account (Super Zero Account), Standard Account, Islamic Account, PAM/MAM, and Pro Trader Account. Start trading with the best-regulated CFD broker – Zero Markets. Enjoy competitive pricing and tight spreads starting from 0.0 pips across more than 60 tradable instruments.

Leave a Reply