Since Wednesday, there are two different perspectives among analysts regarding the post-FOMC speech by Jerome Powell, the President of the American Central Bank, where the American interest rate increased by 0.25%. Some feel that its tone was more subdued, while others feel that it was quite aggressive in parts.

Every political position requires caution, but this one is perhaps the most delicate, perhaps even more important than that of the president. Any misplaced word can generate unwanted interpretations and cause strong volatility in stock markets.

During all the speeches by Powell and the Fed team, analysts and reporters around the world stay tuned, waiting like vultures for carrion. Even though the intention is always to avoid any bias, they end up creating countless theories based on every word.

Nobody knows anything but…

Even with renowned analysts and super software to support forecasts, all of this can be suddenly invalidated by the intensity of recent events. The speed of changes in US interest rate adjustment expectations over the past two weeks is an example of this. We went from a majority bet of a 0.25% adjustment to a majority bet of 0.50% and even a good percentage at 0.75% after the bad inflation data to finally return to 0.25 % where the decision was made on Wednesday.

The truth is that inflation remains very high, with an increase of 0.5% in February and an annual projection of 6%, well above the 2% target. In addition, the US job market is still strong, as evidenced by the drop in jobless claims this week, which requires a higher interest rate to contain inflation.

This was obvious, so much so that bets turned to a larger adjustment without any objection. However, nobody counted on the banking crisis that was about to start, which can be very problematic.

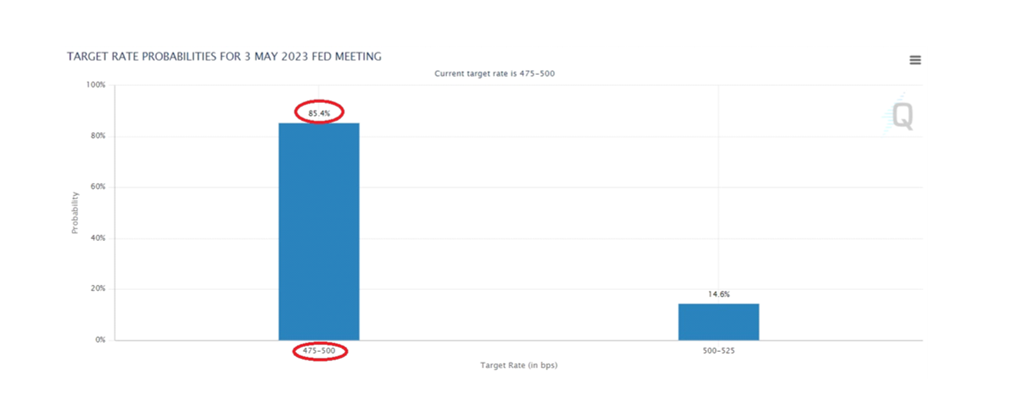

The Fed backed off not only by apparently providing unconditional bailouts to banks, but also by moderating interest rates. Maintaining a low adjustment of 0.25% can be interpreted as an attempt to avoid panic in relation to the banking situation. Stakes for the next meeting are already at 85% for maintenance on May 3rd, which would mean no change.”

Powell also mentioned a possible increase in interest rates later this year and said he only sees the possibility of a reduction in 2024.

Not everything depends on the FOMC

However, it is important to remember that not everything depends exclusively on the decisions of the FOMC (Federal Open Market Committee). The American Central Bank only decides the spot interest rate, while the other rates are freely negotiated in the financial market, directly reflecting investor sentiment. In the chart below we see one of the most used rates for analysis, the two-year rate.

Note that before the banking crisis, the rate was peaking at 5%, and is now trading at 3.8%, the same level as last September.

Europe faces difficult times

Europe is facing a difficult time regarding rate adjustments. Yesterday, the United Kingdom also increased its rate by 0.25%, and the Central Bank of England (BoE) made it clear that further adjustments will be necessary if there are more inflationary pressures, since inflation in the country is above 10%. Citigroup has downgraded Europe’s banking sector to “neutral”, warning that likely upcoming rate hikes raise concerns given the turmoil in the global banking sector.

Gold Analysis

Let’s go to the darling of the moment. Gold surged over 2% yesterday on bets of a pause on monetary tightening at upcoming Fed meetings.

In times of turbulence, investors seek protection assets, such as the dollar, euro, gold. But what if easily printed coins start to raise eyebrows?

The XAUUSD gold contract broke an important resistance level that had not been broken since April last year, at US$1,950.00. In just two trading sessions it rose as much as 4.70%, trading above the next resistance, the round number of $2,000.00. At that point, it encountered strong volatility and pulled back to the 0.38 Fibonacci retracement, where it bounced back up and is now trying again to break above $2,000.00.

Even with all the current context, let’s remember that:

1– The market is very volatile and presents high risk.

2– The price of gold has already gone up 10% recently.

3– There is strong resistance at an important psychological level, the value of US$2,000.00.

It is likely that, even with the ongoing banking crisis, the bullish movement of gold has already occurred and, for new opportunities to exist, market innovations will be necessary. Certainly, these news are yet to come.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply