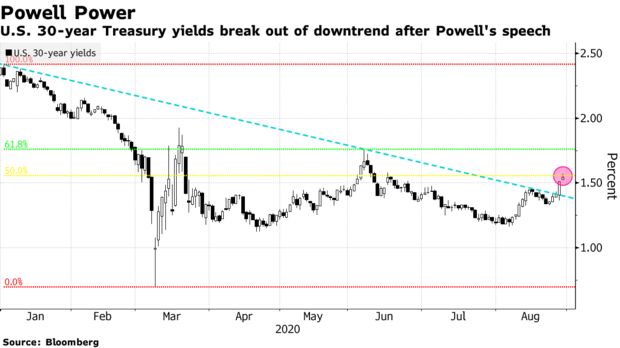

Treasury yields jumped after Jerome Powell said the Federal Reserve will remain accommodative and shift to a more relaxed approach on inflation. U.S. and European stock futures rose along with most Asian equities.

Yield curves steepened in Asia along with U.S. Treasuries after Powell said the Fed will seek inflation that averages 2% over time, a step that implies allowing for periods of overshoots. Australia’s 10-year bond yield breached 1% on Friday for the first time since June as other sovereign notes fell.

Japan stocks saw the bulk of gains, aided by banks. South Korea, China and Hong Kong also climbed, but Australia slid. U.S. and European contracts advanced. The S&P 500 on Thursday reached a fresh all-time high. The Nasdaq Composite also set a record before closing in the red. The dollar retreated, erasing Thursday’s advance.

“Monetary policy is likely to stay accommodative for even longer,” said Tai Hui, chief Asia market strategist at JPMorgan Asset Management. “Not only will the Fed need to provide sufficient support to help the economy through the pandemic fallout, but also policy rates should be kept low beyond that to generate sufficient inflationary pressure.”

Global stocks are heading for a fifth week of gains as technology shares continue to push higher and investors monitor progress on vaccine developments for the pandemic. Reports showed that U.S. weekly jobless claims remained above 1 million and the economy contracted slightly less than forecast in the second quarter.

Elsewhere, crude oil declined as Hurricane Laura weakened while crossing over land in the refinery and LNG-rich Gulf of Mexico region. Gold rose after earlier declining more than 1%.

Here are some key events coming up:

- The U.S. Republican National Convention continues.

- U.S. personal spending and the PCE Deflator data are due Friday.

Bloomberg’s Molly Smith reports on what the Federal Reserve’s shift in policy means for the credit market.

Source: Bloomberg

Here are the main market moves:

Stocks

- S&P 500 futures added 0.6% as of 5:32 a.m. in London. The index rose 0.2% Thursday.

- Japan’s Topix index advanced 1%.

- Hong Kong’s Hang Seng added 0.9%.

- Shanghai Composite increased 0.5%.

- South Korea’s Kospi index rose 0.2%.

- Australia’s S&P/ASX 200 Index dipped 0.8%.

- Euro Stoxx 50 futures rose 0.5%.

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%.

- The yen was at 106.83 per dollar, down 0.2%.

- The offshore yuan climbed 0.2% to 6.8735 per dollar.

- The euro bought $1.1857, up 0.3%

Bonds

- The yield on 10-year Treasuries rose two basis points to 0.77%.

- Australia’s 10-year yield topped 1%, up eight basis points.

Commodities

- West Texas Intermediate crude fell 0.1% to $42.99 a barrel.

- Gold was at $1,940.99, up 0.6%

Source: Bloomberg

Leave a Reply