What is a Pip?

The term Pip is the most fundamental concept that needs to be understood as a Forex trader. Pip stands for “percentage in points” or “price interest point”, it represents the smallest fraction of a currency’s value and is the standard unit for measuring the change of a currency pair.

In most cases, for currency pairs, a single pip is equivalent to the 4th decimal place (0.0001). There are exceptions such as the Japanese Yen (JPY), where a pip is recorded as being 0.01 JPY.

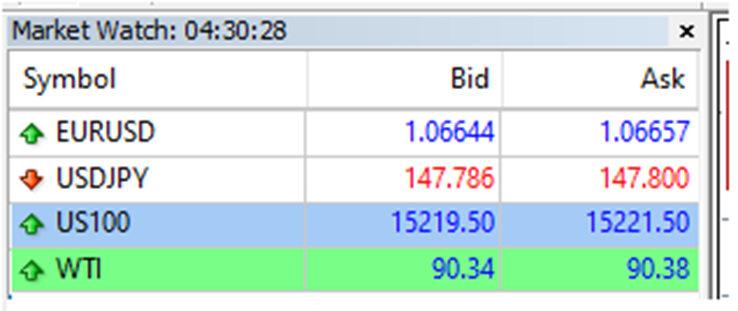

For EURUSD the difference between Bid and Ask is 1.3 pips

For USDJPY the difference between Bid and Ask is 1.4 pips

For US100 the difference between Bid and Ask is 200 pips

For WTI the difference between Bid and Ask is 4 pips

It may seem a little complicated and confusing at first, however as it is used to measure gains and losses it is essential to familiarize yourself with the calculation.

“Pipettes”

Pipettes are fractional pips. Specifically, 1/10 of a pip, mostly represented by the 5th decimal place (0.00001). In the case of USDJPY it would be the 3rd decimal place (0.001).

For US100, and WTI there are no visible pipette value.

The Role of Pips.

Since movement of an exchange rate is measured by pips, the gains and losses are also calculated through it. If you bought a currency pair for 1.13463 and then sold it at 1.13578 you made a profit of 11.5 pips or 115 pipettes.

If you bought a position for a JPY pair at 10.432 and sold it at 10.652 you made a profit of 22 pips or 220 pipettes.

The Bid/Ask Spread or just the spread is also measured in pips. If the ERUUSD Bid price is 1.06644 and the Ask price is 1.06657, the respective spread is 1.3 pips or 13 pipettes.

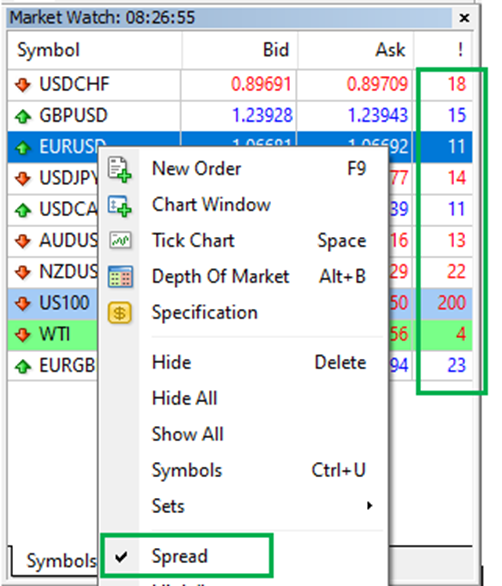

The spread can easily be seen by enabling it on MT4 Market watch.

Crafting Risk-to-Reward ratio with Pips

Most traders are comfortable with a 2:1 Risk-to-Reward ratio, meaning for every unit of risk (distance between entry price and stop loss price) you aim to earn two units of reward (distance between entry price and take profit price).

Suppose you want to set your stop loss just below support and are aiming for a 2:1 risk to reward. Firstly, calculate the number of pips between your entry price and stop loss price.

Next, multiply the number of pips by 2 and add it to the entry price to find the exact take profit price needed for a 2:1 ratio.

Having the ability to calculate pips when setting take profit and stop-loss levels is a powerful tool for traders. It promotes risk management, maximizes profit potential and reinforces a structured trading strategy.

By mastering the concept of pips, traders can better interpret price movements, manage their trades and navigate the complexity of the forex markets.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply