As the world economy continues its delicate dance of recovery, major central banks across the globe are set to make critical decisions on interest rates in the coming week. This pivotal moment has sparked anticipation and speculation, prompting financial experts to analyze the potential outcomes.

Before we dive into the upcoming monetary policy decisions, let’s take a brief look at some recent developments on the economic front.

United States: A Balancing Act

In the United States, the Consumer Price Index (CPI), which measures inflation, recently showed signs of stabilization in service sector inflation, albeit at elevated levels. While this figure didn’t send shockwaves through the markets, it did manage to stay within projected ranges. The core CPI, however, edged slightly higher than expected. The question on everyone’s mind is whether this is enough to justify further monetary tightening by the Federal Reserve.

Currently, market expectations are leaning heavily towards a 99% probability of maintaining the status quo, suggesting a pause in the cycle of interest rate hikes.

The key takeaway here is that the markets are watching Federal Reserve Chair Jerome Powell’s post-FOMC statement closely. Powell is likely to signal that additional tightening may be necessary in the near term, even if it doesn’t officially mark the end of the rate-hike cycle. Some analysts from major U.S. banks are even predicting a planned recession in the U.S. next year, further adding to the intrigue surrounding the Federal Reserve’s decision.

Europe: End of the Road for Tightening?

In contrast to the U.S., the European Central Bank (ECB) recently raised interest rates by +0.25% in the European Union, but it signaled an end to its tightening cycle. A similar move is anticipated from the Bank of England (BoE), where Christine Lagarde is expected to announce the conclusion of the contractionary phase in England after another modest rate adjustment.

Global Economic Calendar

This week’s economic calendar is chock-full of significant events. It’s been dubbed the “Super Wednesday” due to the high-stakes decisions being made by central banks. The United States and Brazil are set to announce their interest rate decisions on Thursday. England and Japan will follow suit on Thursday, and China’s decision is expected on Tuesday.

Additionally, Tuesday brings the Eurozone Consumer Price Index (CPI), and Wednesday will see the release of the UK CPI. The week closes with the U.S. Purchasing Managers’ Index (PMI) on Friday. These events are critical as they provide insights into the economic projections of central banks.

Oil Prices on the Radar

Keep a watchful eye on oil prices, which have been steadily climbing, with West Texas Intermediate (WTI) already surpassing the $90 per barrel mark. It’s important to remember that oil prices have a direct and indirect impact on inflation, and this dynamic will undoubtedly influence future decisions by central banks.

Gold and Currency Markets

The precious metal market, particularly XAUUSD (Gold), has been in consolidation mode, with a triangular pattern forming in an accumulation zone. This aligns with the market’s anticipation of interest rate stability. The real intrigue lies in Powell’s statement post-FOMC, which is expected to trigger increased volatility starting from Wednesday.

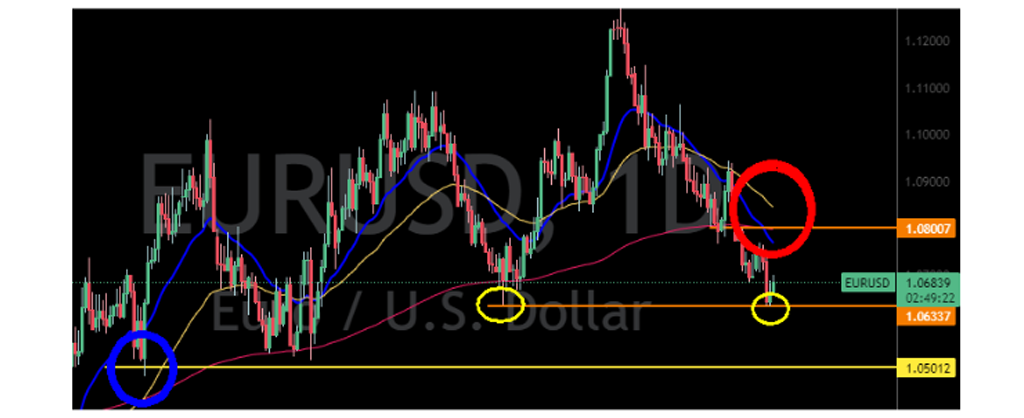

In the currency market, the USD/EUR pair has seen the dollar strengthen against the euro. However, it hasn’t breached key support levels. While it traded below a previously identified trendline, the euro has managed to stay above its last support level. Moving averages have also signaled a strong bearish trend. As we navigate these uncertain times, it’s prudent to exercise caution and keep a close eye on the critical support levels for EUR/USD.

In conclusion, the global economy is at a crossroads, and central banks are tasked with making pivotal decisions to ensure stability and continued recovery. As investors and observers, we must stay vigilant and adapt to the changing landscape as we await the outcomes of these momentous decisions.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply