With the emergence of advanced technologies and the increasing impact of Artificial Intelligence (AI), the question arises: are we facing a financial bubble? In this article, we will explore the phenomenon of speculative bubbles and analyze the possibility of an AI bubble. We will examine how individual investors are reacting, the real potential of AI in various sectors, signs of excessive enthusiasm, and the importance of making research-based and strategic investment decisions. Join us on this journey and discover how to navigate the current landscape and seek sustainable opportunities in the AI-driven financial market.

What is a bubble?

First and foremost, let’s understand what a financial bubble is.

A speculative bubble, also known as a financial bubble, occurs when an asset or product experiences a rapid and extreme increase, causing it to be traded at prices much higher than its real value.

This price increase can be driven by rumors or even by news that leads investors to believe that investing in that particular asset is worthwhile.

However, there is a point where the price becomes inflated, and speculation takes over. In this context, people seek to make profits by buying and selling the asset quickly.

Just as the price rose rapidly, there is also a sharp decline. This results in the collapse of the speculative bubble and usually entails significant losses for investors.

There has been a great buzz around artificial intelligence since ChatGPT emerged on the scene last year, which has significantly boosted the gains of the S&P 500. With all this momentum, it is natural for questions to arise about a possible AI bubble. Moreover, considering that technology giants have transitioned from a negative impact caused by the Federal Reserve’s interest rate hikes to prominent positions in the market within a few months, the question becomes even more relevant.

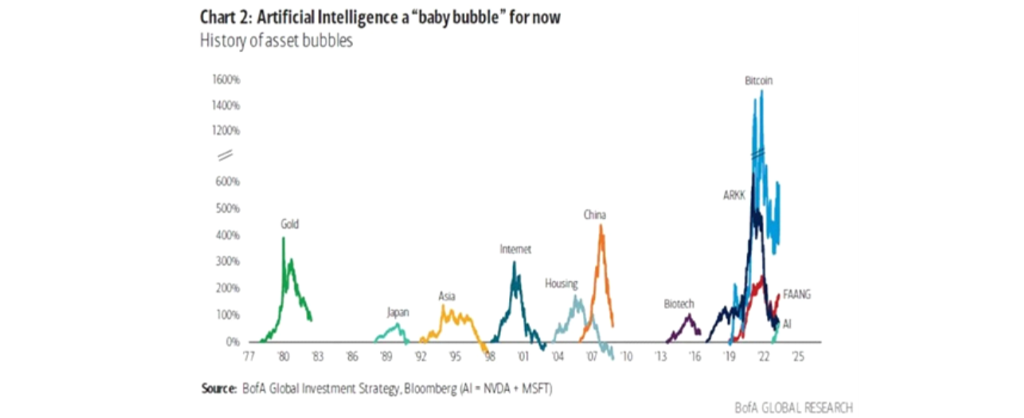

A chart from Bank of America can help put things into perspective: if we are indeed facing an AI bubble, it is still minuscule compared to previous bubbles. However, there is a possibility that this alleged bubble is just beginning to form.

One thing is certain: individual investors have not yet fully embraced it, which means there is potential for additional gains when they do. The excitement surrounding AI is grounded in vast real potential that is already being applied in sectors such as education. According to Goldman Sachs, the productivity increase driven by technology is expected to boost S&P 500 profits by an incredible 30% in the next decade, while other experts believe that there is no established limit to its potential.

It is important to note that, although expectations for AI are high, there are signs of excessive enthusiasm in the sector. The mere mention of “AI” in a press release can drive up a company’s stock. However, the markets are the true arbiters, and over time, they will distinguish quality companies from dubious opportunities in the AI field. Therefore, it is crucial to be cautious and not blindly follow the crowd in an investment. Conduct your own research, look beyond momentary trends, and focus on companies that are better positioned to benefit from this technology. Certainly, there will be obstacles along the way (Bank of America has warned that further Fed interest rate hikes may negatively impact the markets and the enthusiasm surrounding AI), but if you act wisely, you can reap good returns in the long run.

ZERO Markets is a trusted broker offering CFD trading in the global market. ZERO Markets is fully regulated and licensed for your comfort and security. We offer the best trading environment with reduced spreads from 0.0 pip, latest technology platforms and instant deposit channels.

Trade Responsibly: This e-mail may contain general advice which does not take into account your individual circumstances or objectives. CFD derivative products are highly leveraged, carry a high level of risk and are not suitable for all investors. Features of our products including fees and charges are outlined in the relevant legal documents available on our website. The legal documents should be considered before entering into transactions with us. ZERO Markets does not accept applications from residents of countries or jurisdictions where such distribution or use would be contrary to local laws or regulations. Clients receiving services in Saint Vincent and the Grenadines: Zero Markets LLC, which is a registered company of St. Vincent and the Grenadines, Limited Liability Number 503 LLC 2020 uses the Domain www.zeromarkets.com. Please refer to our SVG Privacy Policy. If you are not the intended recipient of this email please do not print, copy or distribute its content or attachments.

Leave a Reply